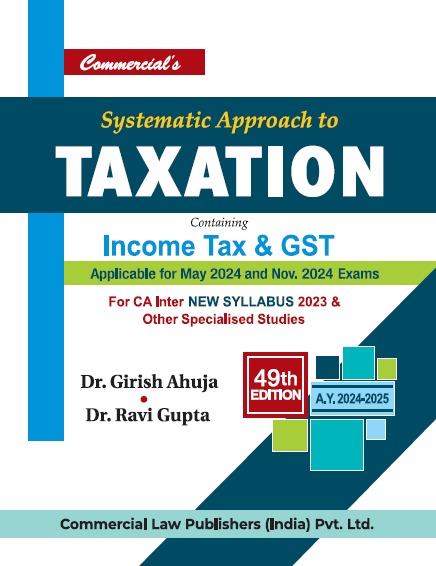

Systematic Approach to Taxation Containing Income Tax & GST (Golden Jubilee Edition 2025)

A Simplified approach to the understanding of a complex subject written in a unique, simple, easy to understand language that enables a quicker grasp for the student. The topics are explained with the help of Tabular and Graphical Presentation to make it simple for students to understand the concept.

Each topic after a theoretical exposition, is followed by plenty of illustrations with solution to facilitate the busy students to Master the practical application of the law. Numerous Problems and Solutions have been given to enable the students to clearly grasp the intricate provisions. There are more than 500 illustrations, Examples, Practical and Theoretical Question Which Help Students to Understand the Practical Aspects.

A Novel feature in the book is The Section-wise-study given in the beginning of each chapter to enable the students to make a systematic study of the law & User-Friendly Examination Oriented Style that facilities the comprehension in both section wise and topic wise manner.

MCQs and Practical Question of all the chapters are covered in "Systematic Approach to Taxation containing Income Tax and GST Multiple Choice Question (MCQs) Practical Question and Solved Questions Paper of Past Examination"

Even the last minute changes in the law have been incorporated in the book and it is therefore, the latest and most up to-date book for the assessment year 2024-2025. The amendment made by the Finance Act, 2023, have been incorporated at appropriate places in the book.

Dr. Girish Ahuja

Dr. Girish Ahuja did his graduation and post-graduation from Shri Ram College of Commerce, Delhi and was a position holder. He was awarded a Ph.D. degree by Faculty of Management Studies (FMS), Delhi University. He is a Fellow of the Institute of Chartered Accountant of India (ICAI) and was a rank holder of both Intermediate and Final examinations of the Institute. He had been nominated by the Government of India as a member of the Task Force for redrafting the Income-tax Act and New Income-tax .......

Dr. Ravi Gupta

Dr. Ravi Gupta did his graduation and post-graduation from Shri Ram College of Commerce. Thereafter, he did LL.B. from Delhi University and MBA (Finance) from Faculty of Management Studies, Delhi. He has been awarded a Ph.D. degree in International Finance by the Delhi University. He had been a faculty member at Shri Ram College of Commerce (Delhi University). He is an advocate and leading consultant at Delhi NCR and also has vast practical experience in handling tax matters of trade and industr.......My Rating

Log In To Add/edit Rating

You Have To Buy The Product To Give A Review

All Ratings

Related Books

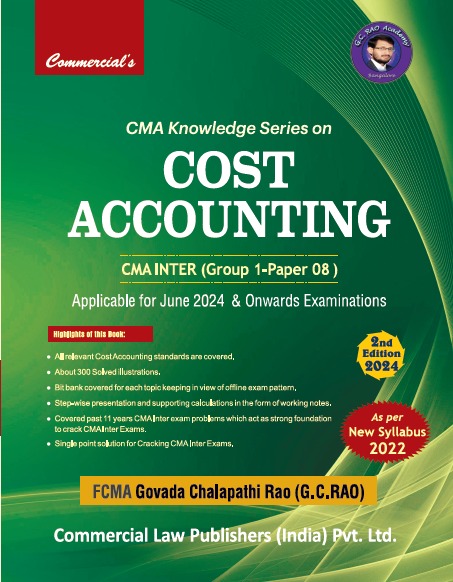

CMA Knowledge Series on Cost Accounting CMA Inter (G-1, Paper-8)

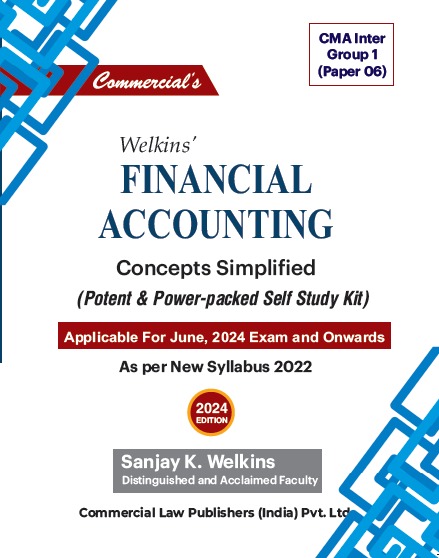

Financial Accounting Concepts Simplified

Systematic Approach to Income Tax (Golden Jubilee Edition 2025)

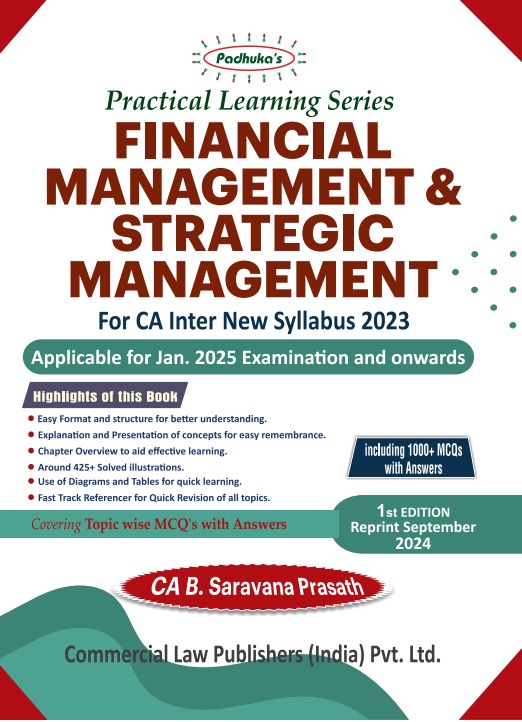

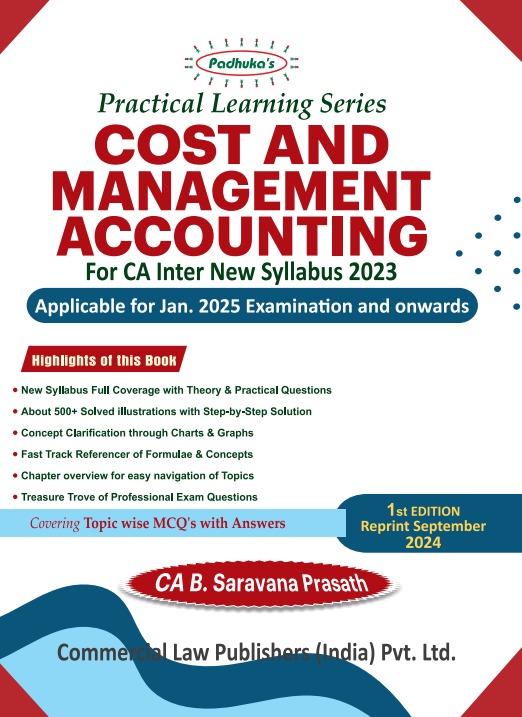

Practical Learning Series—Advanced Accounting (CA Inter New Syllabus)