GST & Indirect Taxes Demystified

₹2,556.00

₹3,195.00

20% Off

100 pc Available

Paperback

English

978-93-90926-75-6

V Raghuraman

V Raghuraman : The focus of this book is to analyse several precedents rendered and its relevance to the GST Laws. Not Only the present GST law, but also decisions on central excise, customs, service tax VAT, NDPS, Income tax, FEMA, COFEPOSA , Foreign Trade Policy are also digested explaining how it would impact GST, Separate Chapters are devoted to analysis of Constitutional Provisions. This Book would be of great value to the gst authorities, lawyers, chartered accountants, Indirect Tax Exper.......My Rating

Log In To Add/edit Rating

You Have To Buy The Product To Give A Review

All Ratings

No Ratings Yet

Related Books

20% Off

Historical Rates Reform in GST 2.0

₹316.00

₹395.00

20% Off

Supreme Court Judgements on GST with Free E Book

₹2,636.00

₹3,295.00

20% Off

Handbook of GST Procedure, Commentary and Rates

₹2,636.00

₹3,295.00

20% Off

Handbook on Drawback of Duties & Taxes

₹1,356.00

₹1,695.00

20% Off

Master Guide to GST Rules

₹1,596.00

₹1,995.00

20% Off

Demystifying GST for the Real Estate Sector

₹556.00

₹695.00

20% Off

Compendium of Top 100 Rulings by Authority of Advance Ruling

₹876.00

₹1,095.00

20% Off

Jurisprudence, Interpretation & General Law

₹396.00

₹495.00

20% Off

How to Handle Customs Problems

₹1,596.00

₹1,995.00

20% Off

GST Rates & Exemptions (on Goods & Service)

₹1,196.00

₹1,495.00

20% Off

GST Manual (A Comprehensive Book on GST Law) As amended by Finance Act, 2025

₹2,397.60

₹2,997.00

20% Off

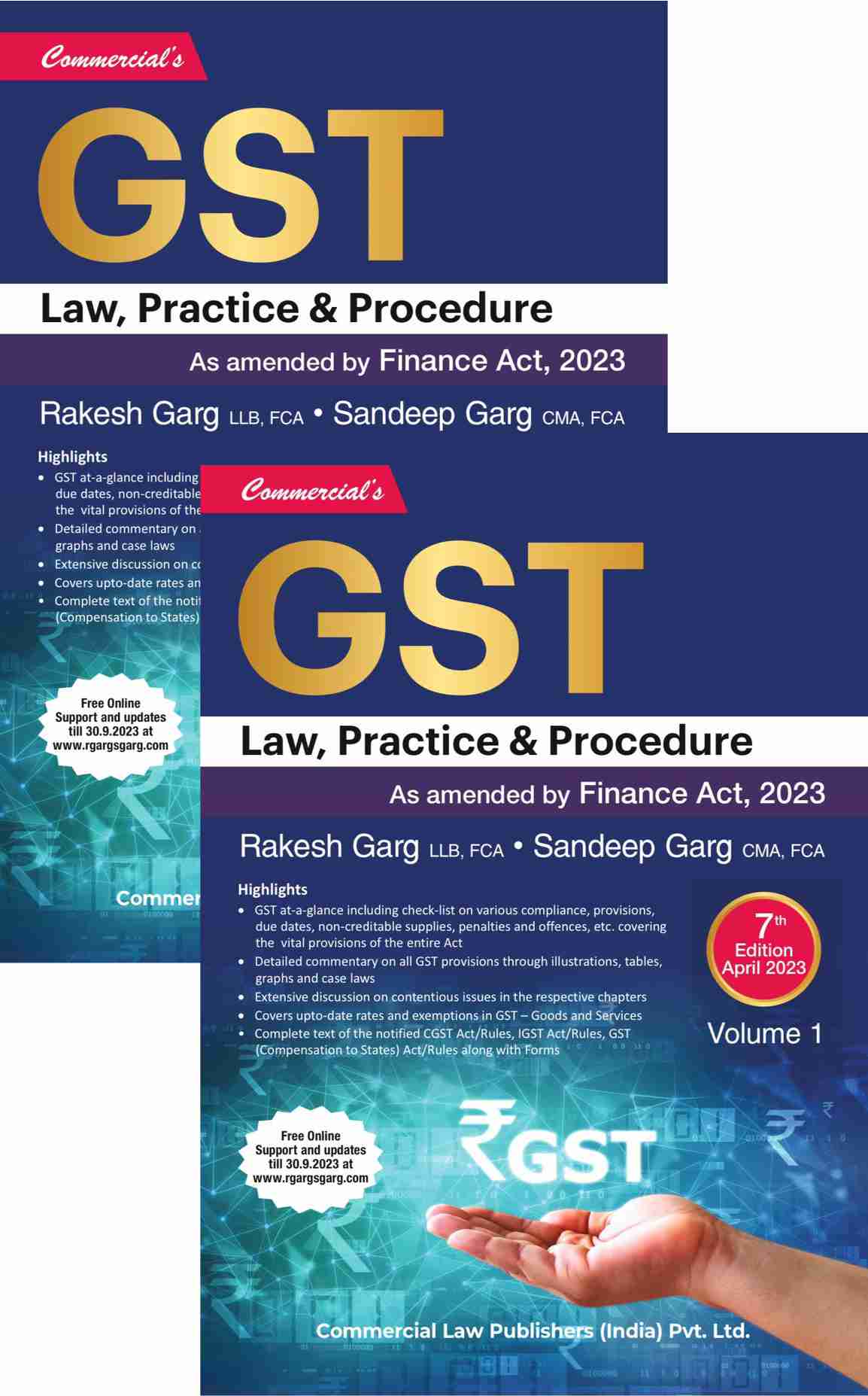

GST Law Practice & Procedure As Amended by Finance Act, 2023

₹5,276.00

₹6,595.00