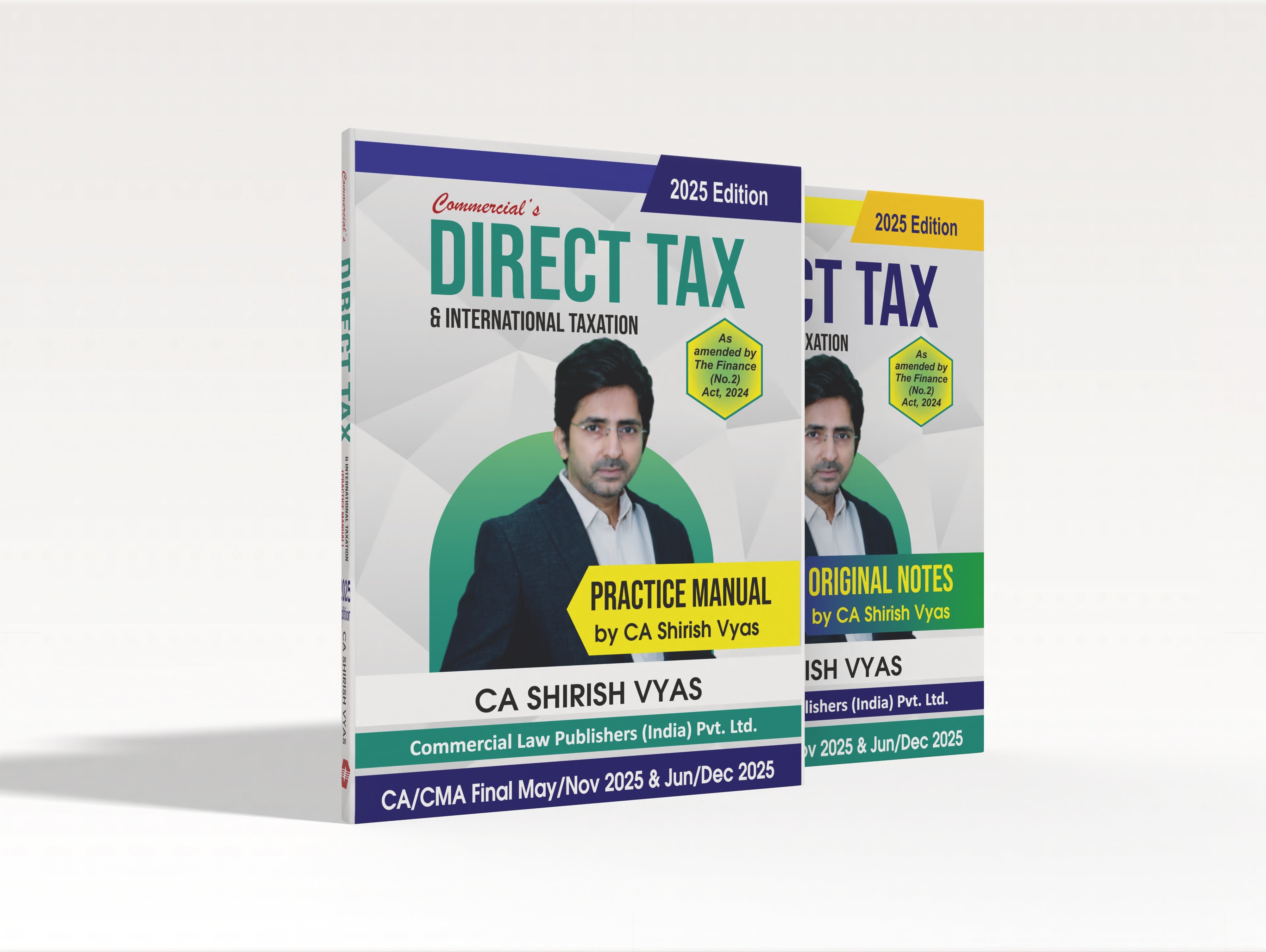

Original Notes & Practical Manual on Direct Tax & International Taxation

This 2025 Edition of Direct Tax & International Taxation by CA Shirish Vyas, updated with all amendments introduced by the Finance Act, 2024 (No. 2 of 2024), is a comprehensive and exam-focused resource for CA/CMA Final students appearing in May/Nov 2025 and Jun/Dec 2025 examinations. Presented in two parts—Original Notes and Practice Manual—this set is meticulously crafted to ensure complete coverage of the syllabus while enhancing conceptual clarity and exam preparedness.

The Original Notes volume provides an in-depth yet simplified explanation of complex provisions, integrating the latest legislative changes and judicial interpretations. The Practice Manual complements it by offering a wide range of questions with solutions, enabling students to test and strengthen their understanding through rigorous practice.

The content covers the full scope of Direct Tax and International Taxation for CA/CMA Final, including:

• Residential status and scope of total income

• Income under various heads – Salaries, House Property, Business/Profession, Capital Gains, and Other Sources

• Deductions under Chapter VI-A and exemptions under various provisions

• Taxation of firms, LLPs, companies, and non-residents

• Minimum Alternate Tax (MAT) and Alternate Minimum Tax (AMT) provisions

• Transfer pricing regulations and arm’s length principle

• International taxation concepts – DTAA provisions, OECD guidelines, and BEPS measures

• Equalisation levy, GAAR, and anti-avoidance measures

• Tax computation and return filing requirements

• Assessment procedures, appeals, revisions, penalties, and prosecutions

• Case law summaries relevant for exams

• Amendments introduced by the Finance Act, 2024 fully integrated in the text

• Exam-oriented question sets in the Practice Manual with detailed, step-by-step answers

This edition is particularly suitable for:

• CA Final and CMA Final aspirants seeking a one-stop solution for both learning and practice

• Students looking for updated, Finance Act–compliant material for May/Nov 2025 and Jun/Dec 2025 exams

• Professionals wanting a structured, clear reference on Direct and International Taxation provisions

• Trainers and academicians in taxation law

By combining detailed explanatory notes with an exhaustive practice component, this edition equips candidates with the knowledge and problem-solving ability necessary to excel in the CA/CMA Final Direct Tax & International Taxation paper.

| Book Format | : | Paperback |

| Language | : | English |

| ISBN-13 | : | 9789356039490 |

| Book Edition | : | 2025 |

Shipping & Returns

Shipping

Orders are shipped within 3–5 working days (exceptions may occur). Deliveries within Delhi usually take 3–5 working days post-shipment, while deliveries outside Delhi may take 4–5 working days. International shipping is not available at present. Once your package has been dispatched, you will receive a confirmation email with a tracking number to monitor your order.

Returns

We do not accept returns or exchanges for books once sold. A return or replacement is only possible if the book delivered is damaged or if the wrong book has been sent. In such cases, customers are requested to contact us within 7 days of delivery with order details and proof (such as a photo of the book). Refunds will be processed once the returned books are received and inspected, and the amount will be credited in the original form of payment within 7 working days. Shipping charges will not be refunded unless the return is due to our error.

Shipping & Returns

Shipping

Orders are shipped within 3–5 working days (exceptions may occur). Deliveries within Delhi usually take 3–5 working days post-shipment, while deliveries outside Delhi may take 4–5 working days. International shipping is not available at present. Once your package has been dispatched, you will receive a confirmation email with a tracking number to monitor your order.

Returns

We do not accept returns or exchanges for books once sold. A return or replacement is only possible if the book delivered is damaged or if the wrong book has been sent. In such cases, customers are requested to contact us within 7 days of delivery with order details and proof (such as a photo of the book). Refunds will be processed once the returned books are received and inspected, and the amount will be credited in the original form of payment within 7 working days. Shipping charges will not be refunded unless the return is due to our error.

Warranty

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Warranty

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Secure Payment

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Secure Payment

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

About the author

Related Products

Your cart

Your cart is empty

- Choosing a selection results in a full page refresh.

- Opens in a new window.