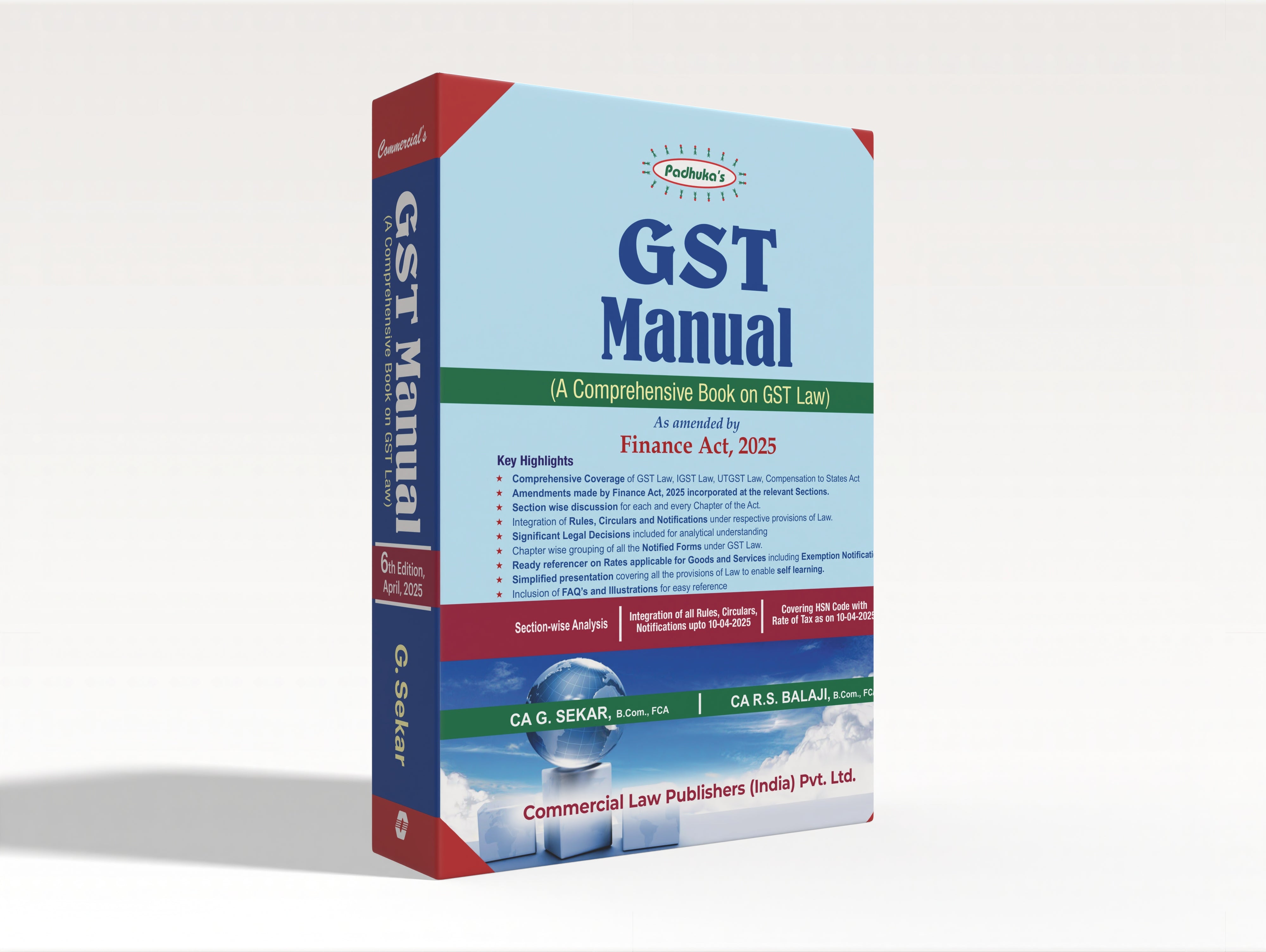

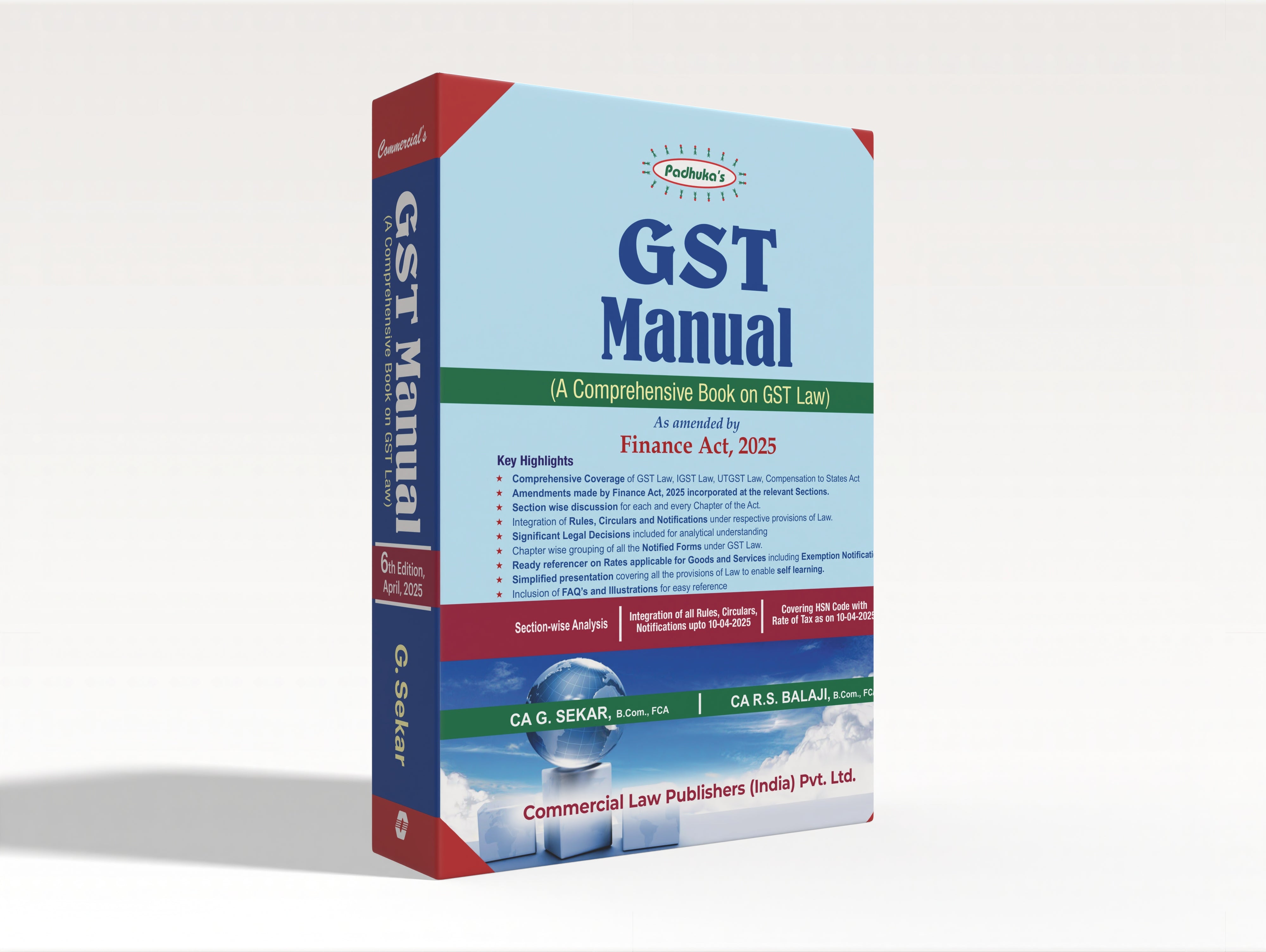

GST Manual (A Comprehensive Book on GST Law)

GST Manual (A Comprehensive Book on GST Law)

This latest edition of Paduka’s GST Manual, authored by CA G. Sekar and CA R.S. Balaji, offers a comprehensive and authoritative guide to the Goods and Services Tax law, fully updated as per the Finance Act, 2025. Designed for tax practitioners, corporate professionals, students, and academicians, the book presents the entire GST framework in a clear, section-wise analytical format, supplemented with notifications, circulars, and relevant case law.

Key Features include:

• Complete coverage of the CGST Act, 2017, IGST Act, 2017, UTGST Act, 2017, GST (Compensation to States) Act, 2017, and relevant rules.

• Amendments brought in by the Finance Act, 2025, clearly highlighted for easy identification.

• Section-wise presentation of GST provisions with corresponding rules, notifications, and relevant CBIC circulars.

• Easy-to-read tables for quick reference to rates, exemptions, due dates, and procedural requirements.

• Detailed explanation of critical concepts such as supply, place of supply, time of supply, input tax credit, registration, returns, assessments, appeals, penalties, and prosecution.

• Integration of all latest circulars, clarifications, and notifications issued up to 10-04-2025.

• Includes recent case law and practical illustrations to aid real-world application.

This edition is invaluable for:

• Chartered Accountants, Company Secretaries, Cost Accountants, and tax practitioners

• Legal professionals and corporate compliance officers

• GST officers and departmental trainees

• Students preparing for CA, CMA, CS, and other professional exams with GST syllabus coverage

By combining legislative precision with practical clarity, GST Manual serves as a one-stop reference for mastering GST law, ensuring users stay compliant and informed in the ever-evolving indirect tax regime.

| Book Format | : | Paperback |

| Language | : | English |

| ISBN-13 | : | 9789356036871 |

| Book Edition | : | 6th Edition 2025 |

Shipping & Returns

Shipping

Orders are shipped within 3–5 working days (exceptions may occur). Deliveries within Delhi usually take 3–5 working days post-shipment, while deliveries outside Delhi may take 4–5 working days. International shipping is not available at present. Once your package has been dispatched, you will receive a confirmation email with a tracking number to monitor your order.

Returns

We do not accept returns or exchanges for books once sold. A return or replacement is only possible if the book delivered is damaged or if the wrong book has been sent. In such cases, customers are requested to contact us within 7 days of delivery with order details and proof (such as a photo of the book). Refunds will be processed once the returned books are received and inspected, and the amount will be credited in the original form of payment within 7 working days. Shipping charges will not be refunded unless the return is due to our error.

Shipping & Returns

Shipping

Orders are shipped within 3–5 working days (exceptions may occur). Deliveries within Delhi usually take 3–5 working days post-shipment, while deliveries outside Delhi may take 4–5 working days. International shipping is not available at present. Once your package has been dispatched, you will receive a confirmation email with a tracking number to monitor your order.

Returns

We do not accept returns or exchanges for books once sold. A return or replacement is only possible if the book delivered is damaged or if the wrong book has been sent. In such cases, customers are requested to contact us within 7 days of delivery with order details and proof (such as a photo of the book). Refunds will be processed once the returned books are received and inspected, and the amount will be credited in the original form of payment within 7 working days. Shipping charges will not be refunded unless the return is due to our error.

Warranty

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Warranty

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Secure Payment

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Secure Payment

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

About the author

Related Products

Your cart

Your cart is empty

- Choosing a selection results in a full page refresh.

- Opens in a new window.