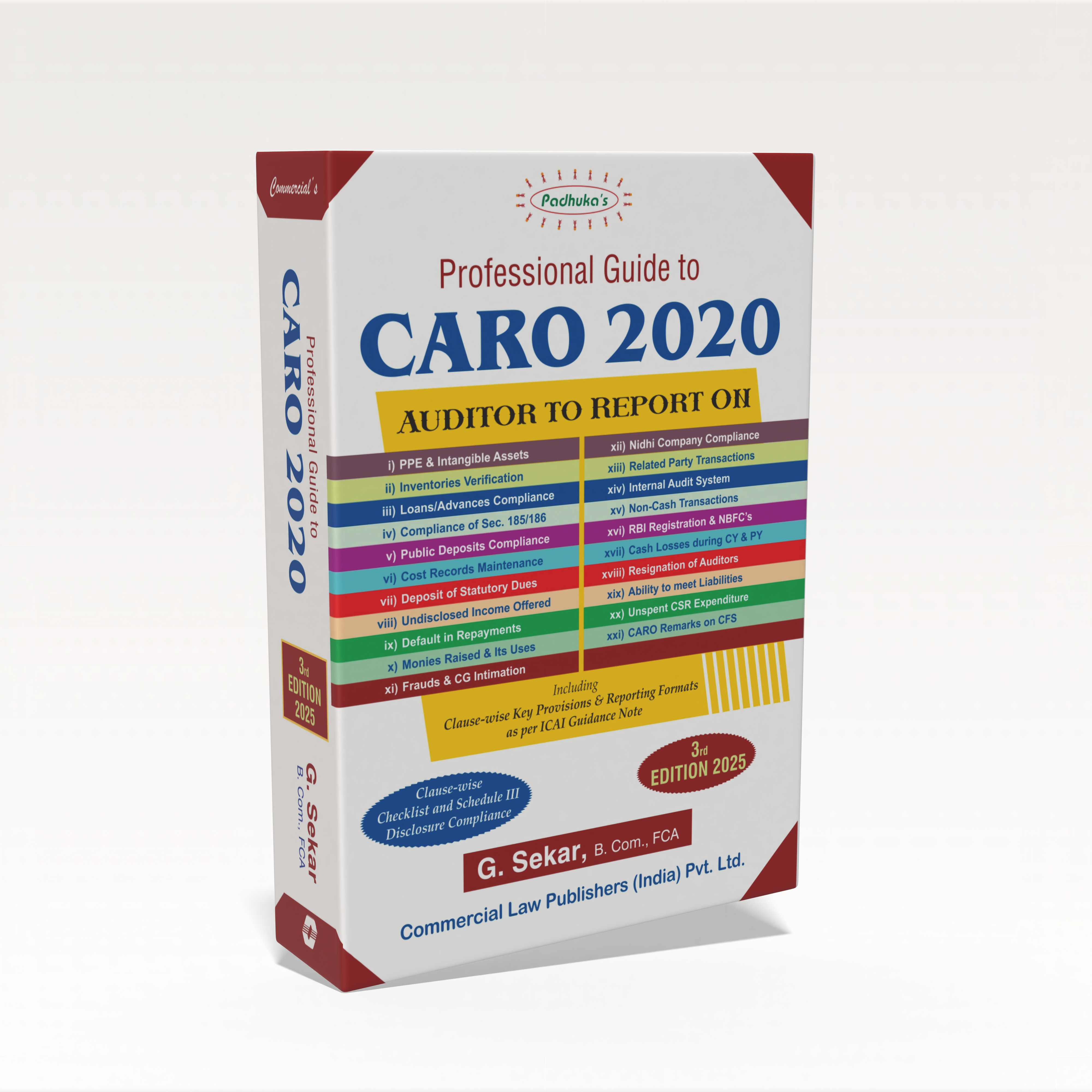

Professional Guide to CARO 2020

Professional Guide to CARO 2020

This 3rd Edition (2025) of Professional Guide to CARO 2020 by G. Sekar, published by Commercial Law Publishers (India) Pvt. Ltd., offers an in-depth and practical interpretation of the Companies (Auditor’s Report) Order, 2020, updated as per the latest amendments and ICAI Guidance Note.

The book provides clause-by-clause commentary along with reporting formats, making it an indispensable guide for auditors, accountants, and corporate professionals tasked with compliance under CARO 2020.

Key features include:

• Comprehensive coverage of all reporting clauses, including PPE & intangible assets, inventory verification, loans & advances, compliance with Sections 185/186, public deposits, cost records, statutory dues, undisclosed income, repayment defaults, frauds, company registration & NBFC matters, related party transactions, internal audit systems, and CSR reporting

• Clause-wise analysis with practical checklists to ensure thorough compliance

• Guidance on drafting CARO reports with illustrative formats

• Special focus on reporting in case of branch audits, consolidated financial statements, and industry-specific scenarios

• Inclusion of Schedule III disclosure requirements and cross-references to Companies Act, 2013 provisions

• Highlights of common pitfalls, red-flag indicators, and audit best practices

This edition is highly useful for:

• Statutory auditors and audit firms

• Chartered Accountants and accounting professionals

• Company secretaries and compliance officers

• Corporate finance teams responsible for statutory reporting

With its clear structure, practical approach, and updated coverage, this book is a must-have guide for ensuring robust and accurate auditor reporting under CARO 2020.

| Book Format | : | Paperback |

| Language | : | English |

| ISBN-13 | : | 9789356036598 |

| Book Edition | : | 3rd Edition 2025 |

Shipping & Returns

Shipping

Orders are shipped within 3–5 working days (exceptions may occur). Deliveries within Delhi usually take 3–5 working days post-shipment, while deliveries outside Delhi may take 4–5 working days. International shipping is not available at present. Once your package has been dispatched, you will receive a confirmation email with a tracking number to monitor your order.

Returns

We do not accept returns or exchanges for books once sold. A return or replacement is only possible if the book delivered is damaged or if the wrong book has been sent. In such cases, customers are requested to contact us within 7 days of delivery with order details and proof (such as a photo of the book). Refunds will be processed once the returned books are received and inspected, and the amount will be credited in the original form of payment within 7 working days. Shipping charges will not be refunded unless the return is due to our error.

Shipping & Returns

Shipping

Orders are shipped within 3–5 working days (exceptions may occur). Deliveries within Delhi usually take 3–5 working days post-shipment, while deliveries outside Delhi may take 4–5 working days. International shipping is not available at present. Once your package has been dispatched, you will receive a confirmation email with a tracking number to monitor your order.

Returns

We do not accept returns or exchanges for books once sold. A return or replacement is only possible if the book delivered is damaged or if the wrong book has been sent. In such cases, customers are requested to contact us within 7 days of delivery with order details and proof (such as a photo of the book). Refunds will be processed once the returned books are received and inspected, and the amount will be credited in the original form of payment within 7 working days. Shipping charges will not be refunded unless the return is due to our error.

Warranty

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Warranty

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Secure Payment

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Secure Payment

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

About the author

Related Products

Your cart

Your cart is empty

- Choosing a selection results in a full page refresh.

- Opens in a new window.