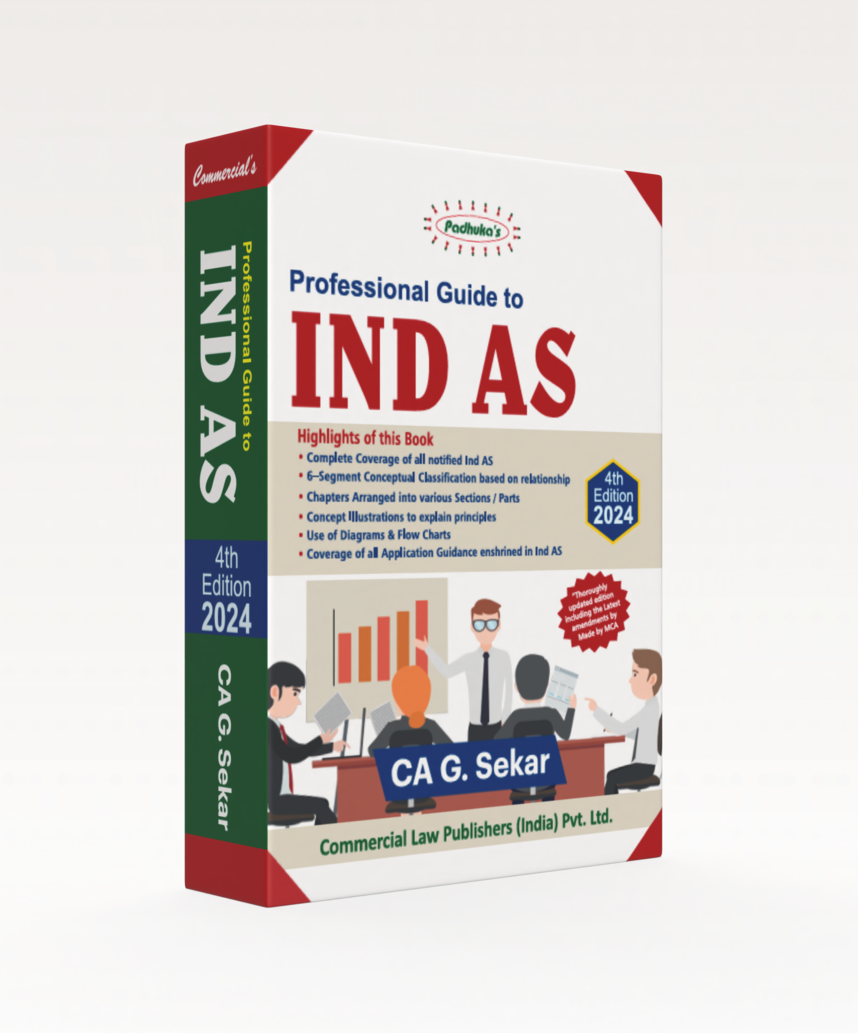

Professional Guide to Ind AS

This 4th Edition 2024 of Professional Guide to IND AS, authored by CA G. Sekar, is a comprehensive and structured reference covering all notified Indian Accounting Standards (IND AS) with conceptual clarity and practical illustrations. Designed for professionals, corporates, and students, the book ensures complete alignment with the latest statutory requirements and application guidance.

Organized into a 6-segment conceptual classification based on relationships between standards, the book facilitates better understanding and application of IND AS in varied business contexts. Chapters are systematically arranged according to sections and parts, supported by flow charts, diagrams, and concept illustrations for ease of comprehension.

The content covers:

• Complete coverage of all notified IND AS

• 6-segment conceptual classification for logical understanding

• Chapter-wise organization based on sections/parts for easy navigation

• Concept illustrations with practical examples for clarity

• Extensive use of diagrams, charts, and flow charts

• Application guidance as enshrined in IND AS

• Updates reflecting recent changes in accounting and reporting norms

• Insights into practical challenges in applying IND AS to real-world situations

This edition is particularly useful for:

• Chartered accountants, cost accountants, and company secretaries

• Finance managers and corporate accountants handling IND AS compliance

• Auditors and consultants advising on accounting standards

• Commerce and management students preparing for professional exams

With its methodical approach, updated content, and illustrative style, this book serves as a single-point reference for mastering IND AS and ensuring full compliance with Indian accounting standards.

| Book Format | : | Paperback |

| Language | : | English |

| ISBN-13 | : | 9789356037687 |

| Book Edition | : | 4th Edition, 2024 |

Shipping & Returns

Shipping

Orders are shipped within 3–5 working days (exceptions may occur). Deliveries within Delhi usually take 3–5 working days post-shipment, while deliveries outside Delhi may take 4–5 working days. International shipping is not available at present. Once your package has been dispatched, you will receive a confirmation email with a tracking number to monitor your order.

Returns

We do not accept returns or exchanges for books once sold. A return or replacement is only possible if the book delivered is damaged or if the wrong book has been sent. In such cases, customers are requested to contact us within 7 days of delivery with order details and proof (such as a photo of the book). Refunds will be processed once the returned books are received and inspected, and the amount will be credited in the original form of payment within 7 working days. Shipping charges will not be refunded unless the return is due to our error.

Shipping & Returns

Shipping

Orders are shipped within 3–5 working days (exceptions may occur). Deliveries within Delhi usually take 3–5 working days post-shipment, while deliveries outside Delhi may take 4–5 working days. International shipping is not available at present. Once your package has been dispatched, you will receive a confirmation email with a tracking number to monitor your order.

Returns

We do not accept returns or exchanges for books once sold. A return or replacement is only possible if the book delivered is damaged or if the wrong book has been sent. In such cases, customers are requested to contact us within 7 days of delivery with order details and proof (such as a photo of the book). Refunds will be processed once the returned books are received and inspected, and the amount will be credited in the original form of payment within 7 working days. Shipping charges will not be refunded unless the return is due to our error.

Warranty

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Warranty

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Secure Payment

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Secure Payment

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

About the author

Related Products

Your cart

Your cart is empty

- Choosing a selection results in a full page refresh.

- Opens in a new window.