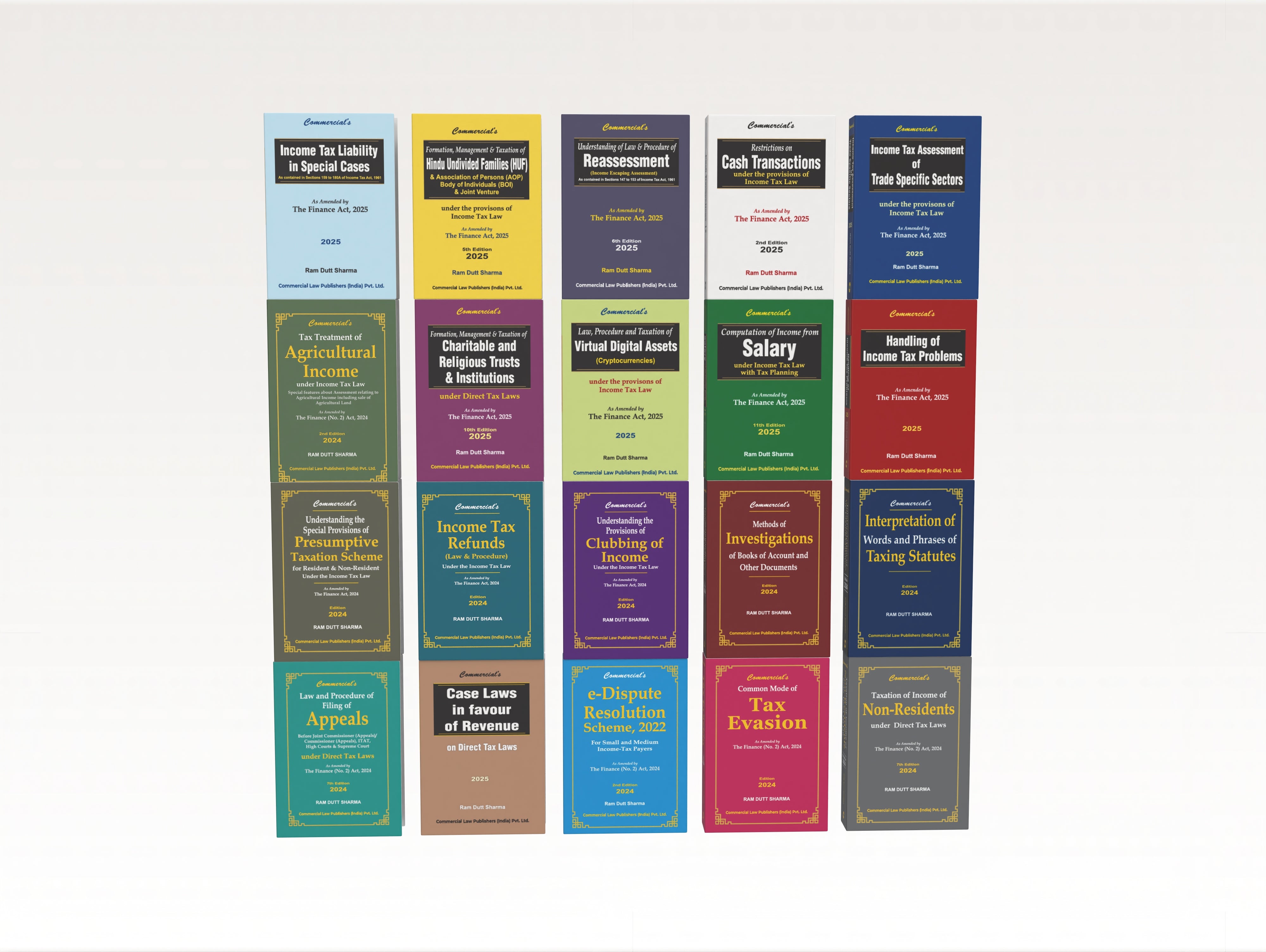

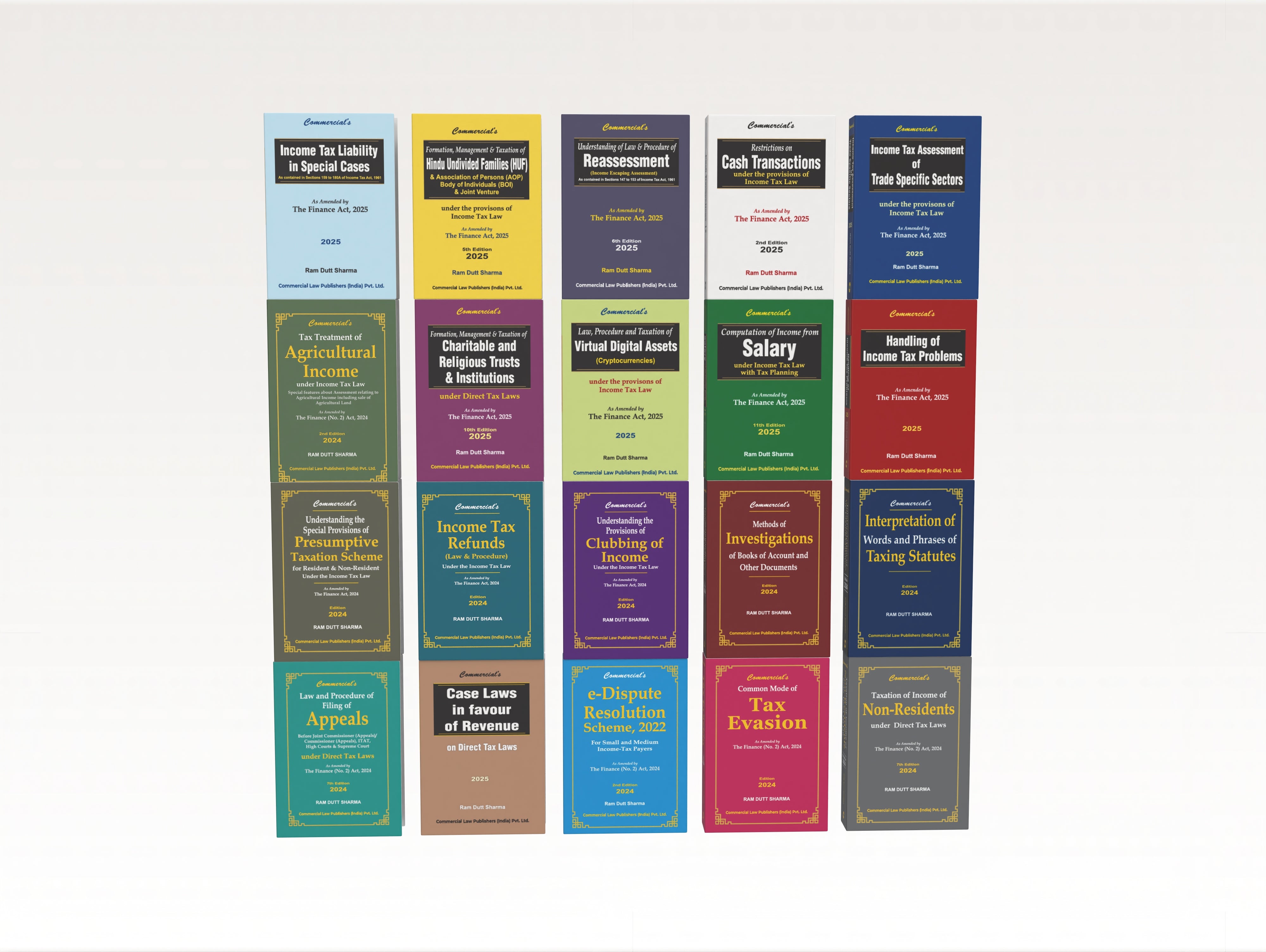

Tax professionals — Combo Pack (20 books)

Size Chart (Women)

TOPS + DRESSES

| Size | Bust | Waist | Hips | US/CAN |

| XS | 32-33 | 24-25 | 35-36 | 0/1 |

| S | 34-35 | 26-27 | 37-38 | 3/5 |

| M | 36-37 | 28-29 | 39-40 | 7/9 |

| L | 38.5-40 | 30.5-32 | 41.5-43 | 11/13 |

| XL | 41 1/2 | 33 1/2 | 44 1/2 | 15 |

| 1X | 44-45.5 | 37-38.5 | 47-48.5 | 14/16 |

| 2X | 47-49 | 40-42 | 50-52 | 18/20 |

| 3X | 51-53 | 44-46 | 54-56 | 22/24 |

Pants / Shorts / Skirts

| Size EU | Size UK | Waist | Hip |

|---|---|---|---|

| XS / 34 | 6 | 78-82 | 87-91 |

| S / 36 | 8 | 82-86 | 91-95 |

| M / 38 | 10 | 86-90 | 95-99 |

| L / 40 | 12 | 90-94 | 99-103 |

| XL / 42 | 14 | 90-98 | 103-107 |

Size Chart (Women)

Tops

| Size EU | Size UK | Chest | Waist | Hip |

|---|---|---|---|---|

| XS / 34 | 6 | 78-82 | 60-64 | 87-91 |

| S / 36 | 8 | 82-86 | 64-68 | 91-95 |

| M / 38 | 10 | 86-90 | 68-72 | 95-99 |

| L / 40 | 12 | 90-94 | 72-76 | 99-103 |

| XL / 42 | 14 | 90-98 | 76-80 | 103-107 |

Pants / Shorts / Skirts

| Size EU | Size UK | Waist | Hip |

|---|---|---|---|

| XS / 34 | 6 | 78-82 | 87-91 |

| S / 36 | 8 | 82-86 | 91-95 |

| M / 38 | 10 | 86-90 | 95-99 |

| L / 40 | 12 | 90-94 | 99-103 |

| XL / 42 | 14 | 90-98 | 103-107 |

This 2025 Edition Commercial’s Income Tax Special Topics – 20 Book Combo Pack offers a complete, in-depth, and practice-oriented reference covering critical and niche aspects of Indian Income Tax law. Authored by leading tax experts, the set incorporates all amendments introduced by the Finance Act, 2025, making it a ready resource for tax professionals, corporate accountants, legal practitioners, and advanced students of taxation.

Spanning 20 specialised volumes, this set addresses complex tax issues with focused guidance, updated legal provisions, judicial interpretations, and real-world case studies. It is designed to equip professionals with practical strategies for compliance, advisory, and dispute resolution.

The set includes:

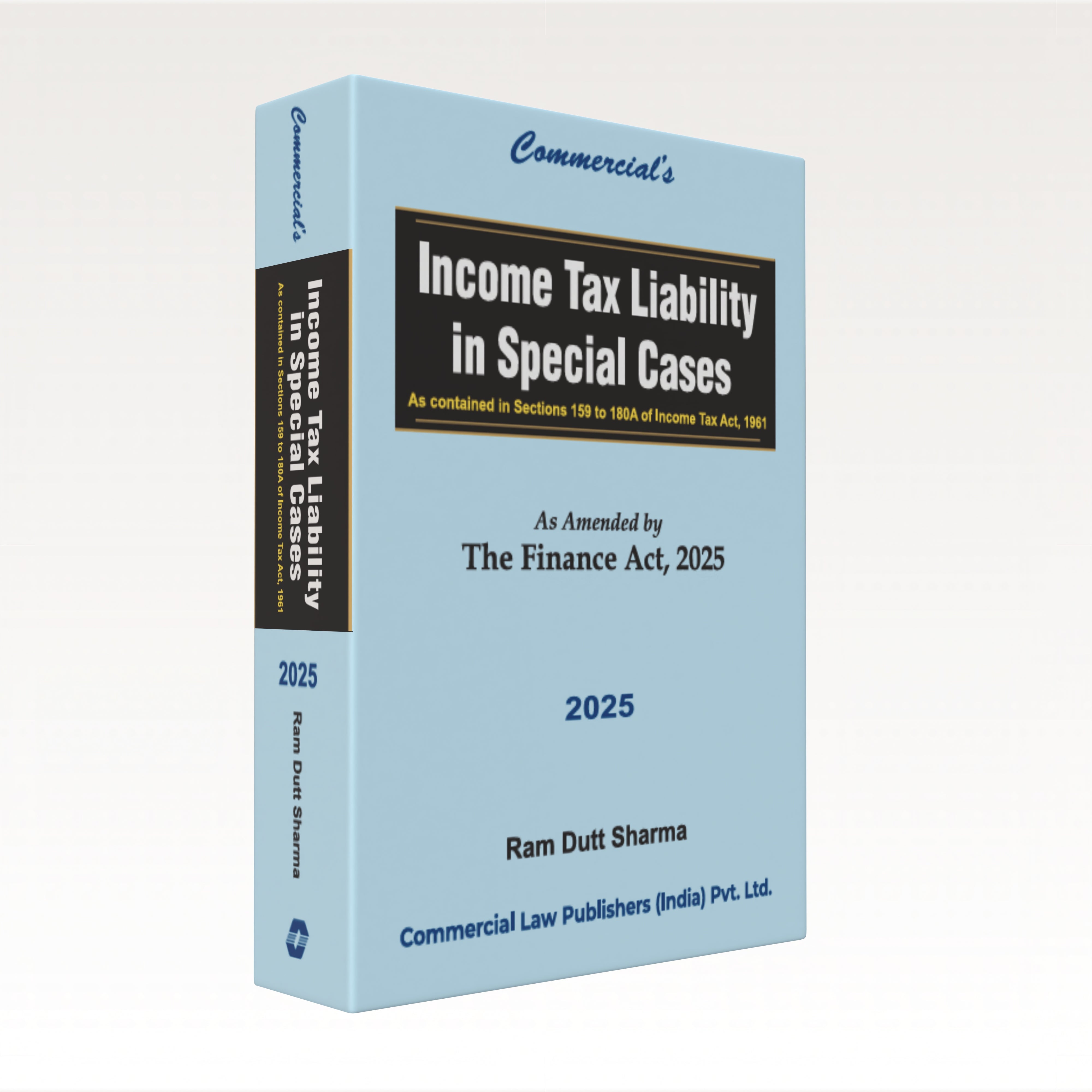

Income Tax Liability in Special Cases

Taxation of Dividend, Family Trusts, and Business Trusts

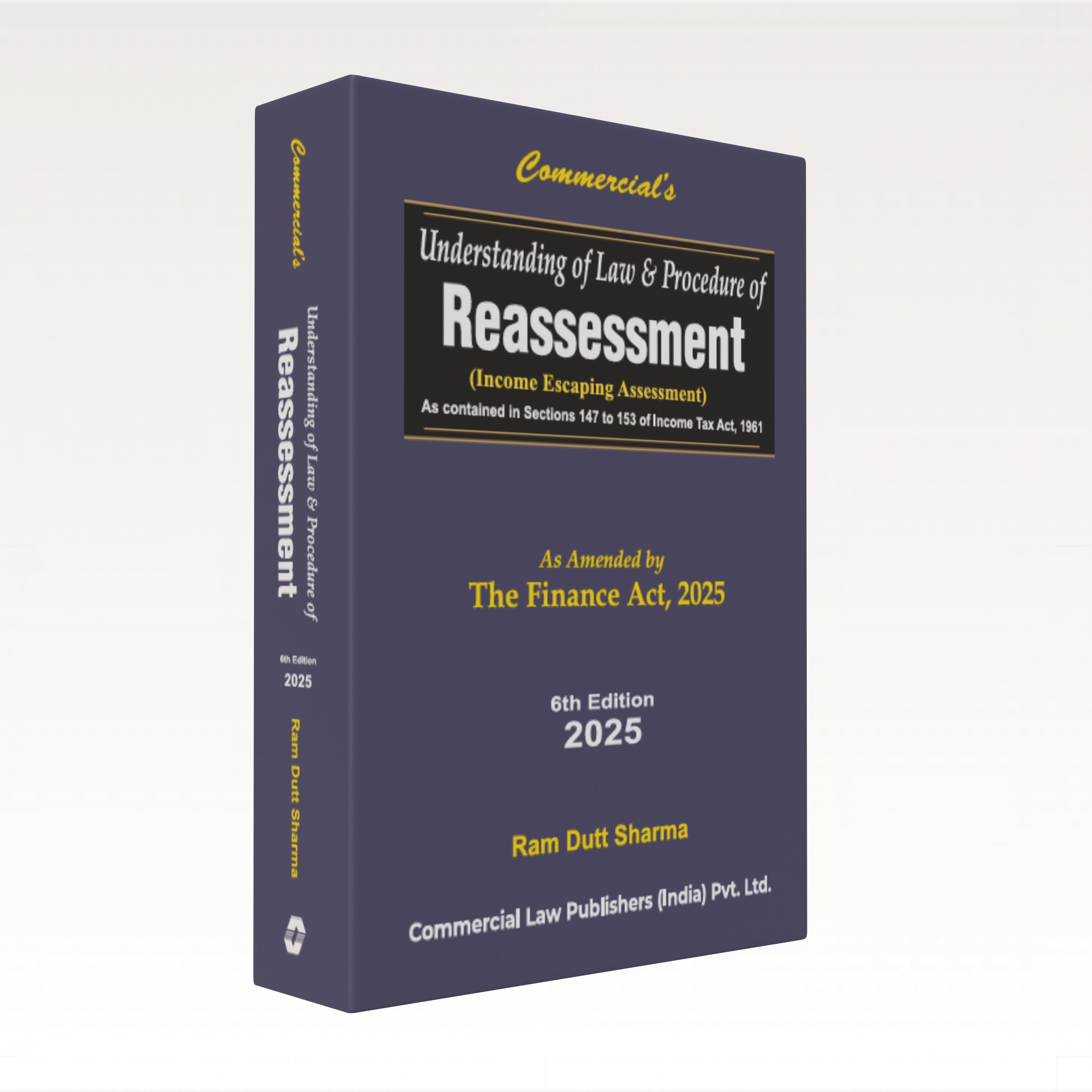

Reassessment

Cash Transactions

Income from Other Sources & Taxation of Gifts

Tax Treatment of Agricultural Income

Tax Treatment of Charitable and Religious Trusts & Institutions

Taxation of Virtual Digital Assets

Computation of Salary Income

Taxation of Remuneration of Partners and Profits from Partnership Firms

Understanding & Applying Presumptive Taxation Scheme

Income Tax Refunds

Clubbing of Income

Investigation of Cases under Income Tax Act

Interpretation of Various Provisions of Taxing Statutes

Law & Procedure of Filing and Handling Appeals under the Income Tax Act

Case Laws in Favour of Revenue

e-Dispute Resolution Scheme, 2022

Tax Evasion – Law, Penalties & Prosecution

Taxation of Non-Residents

Key features across the set:

• Complete coverage of amendments by the Finance Act, 2025

• Section-wise explanations and practical illustrations

• Guidance on procedural compliances, documentation, and filing requirements

• Analytical commentary on judicial pronouncements and CBDT circulars

• Specialised treatment of niche topics like Virtual Digital Assets, Presumptive Taxation, Tax Evasion, and Non-Resident Taxation

• Ready-to-use checklists, templates, and procedural flowcharts

• Practical tips for avoiding litigation and ensuring compliance efficiency

• Ideal blend of academic depth and professional application

This combo pack is particularly suitable for:

• Chartered accountants, tax practitioners, and advocates

• Corporate finance teams and compliance officers

• Litigators involved in income tax disputes

• Advanced students and academicians specialising in tax law

• Policy analysts and researchers studying the evolving Indian tax framework

Whether for day-to-day practice, specialised client advisory, or academic reference, this pack delivers a one-stop, authoritative library on the most significant and complex topics under the Income Tax Act in 2025.

| Book Format | : | Paperback |

| Language | : | English |

| ISBN-13 | : | |

| Book Edition | : |

Shipping & Returns

Shipping

Orders are shipped within 3–5 working days (exceptions may occur). Deliveries within Delhi usually take 3–5 working days post-shipment, while deliveries outside Delhi may take 4–5 working days. International shipping is not available at present. Once your package has been dispatched, you will receive a confirmation email with a tracking number to monitor your order.

Returns

We do not accept returns or exchanges for books once sold. A return or replacement is only possible if the book delivered is damaged or if the wrong book has been sent. In such cases, customers are requested to contact us within 7 days of delivery with order details and proof (such as a photo of the book). Refunds will be processed once the returned books are received and inspected, and the amount will be credited in the original form of payment within 7 working days. Shipping charges will not be refunded unless the return is due to our error.

Shipping & Returns

Shipping

Orders are shipped within 3–5 working days (exceptions may occur). Deliveries within Delhi usually take 3–5 working days post-shipment, while deliveries outside Delhi may take 4–5 working days. International shipping is not available at present. Once your package has been dispatched, you will receive a confirmation email with a tracking number to monitor your order.

Returns

We do not accept returns or exchanges for books once sold. A return or replacement is only possible if the book delivered is damaged or if the wrong book has been sent. In such cases, customers are requested to contact us within 7 days of delivery with order details and proof (such as a photo of the book). Refunds will be processed once the returned books are received and inspected, and the amount will be credited in the original form of payment within 7 working days. Shipping charges will not be refunded unless the return is due to our error.

Warranty

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Warranty

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Secure Payment

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Secure Payment

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Related Products

Your cart

Your cart is empty

- Choosing a selection results in a full page refresh.

- Opens in a new window.