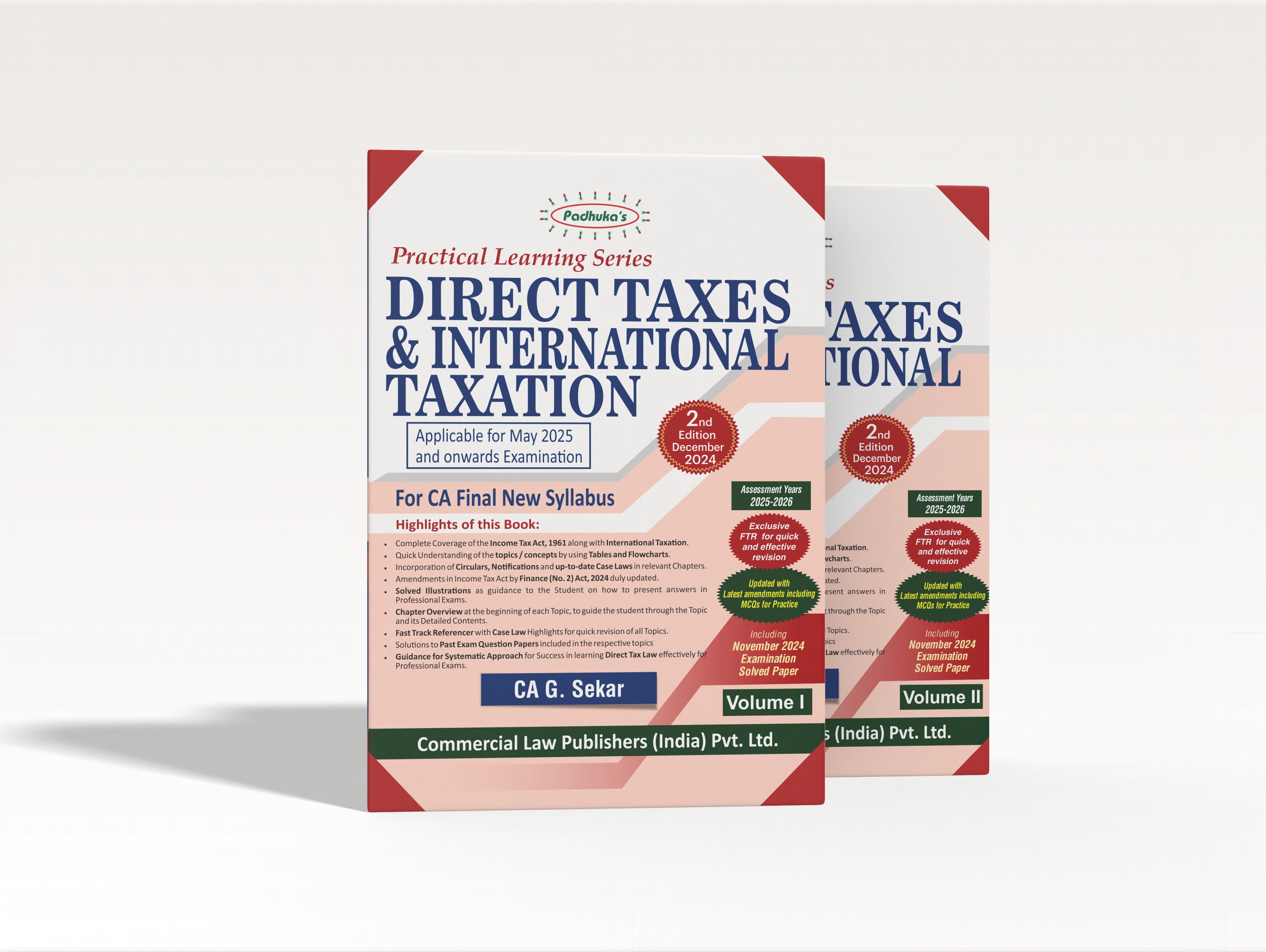

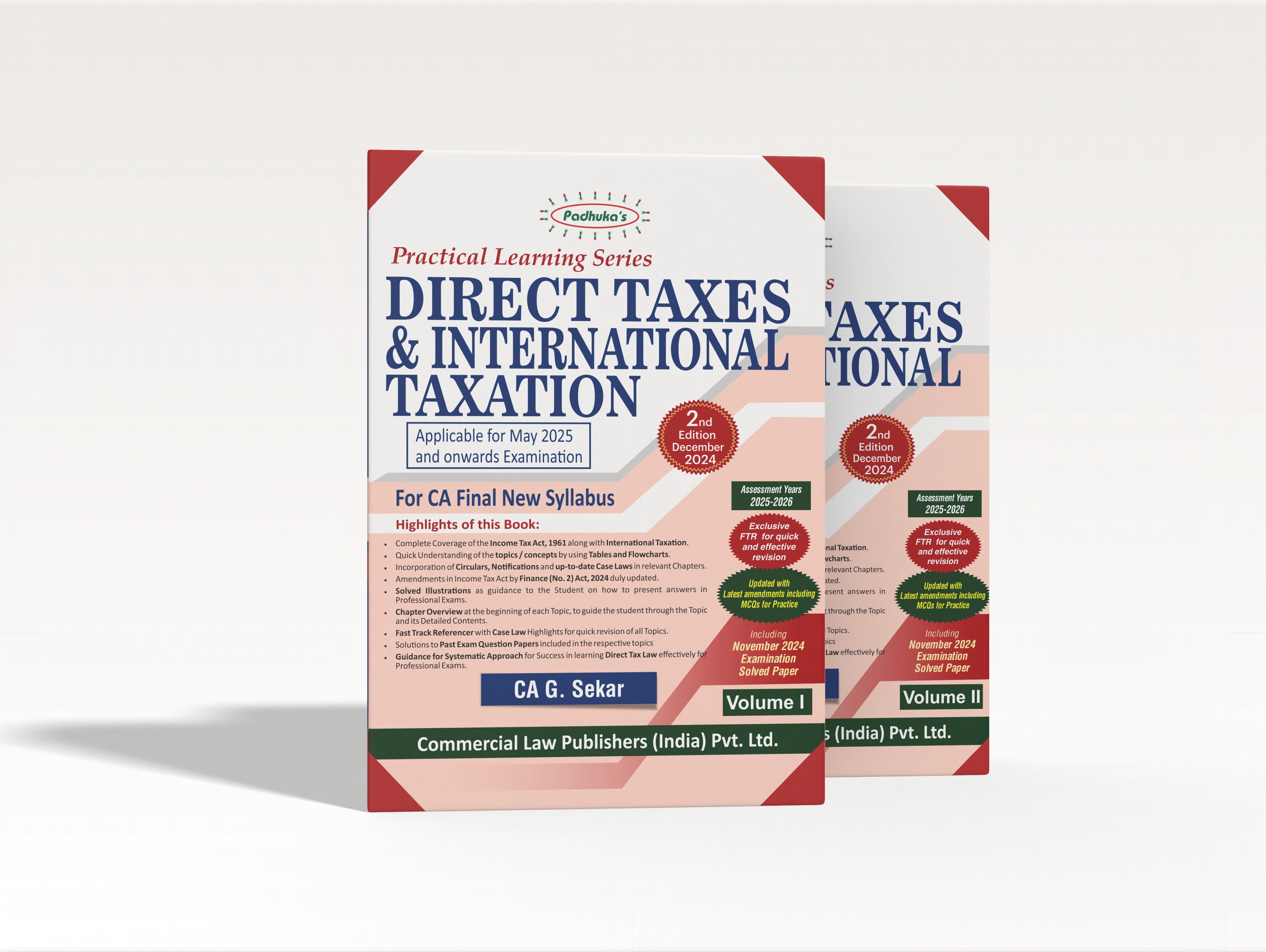

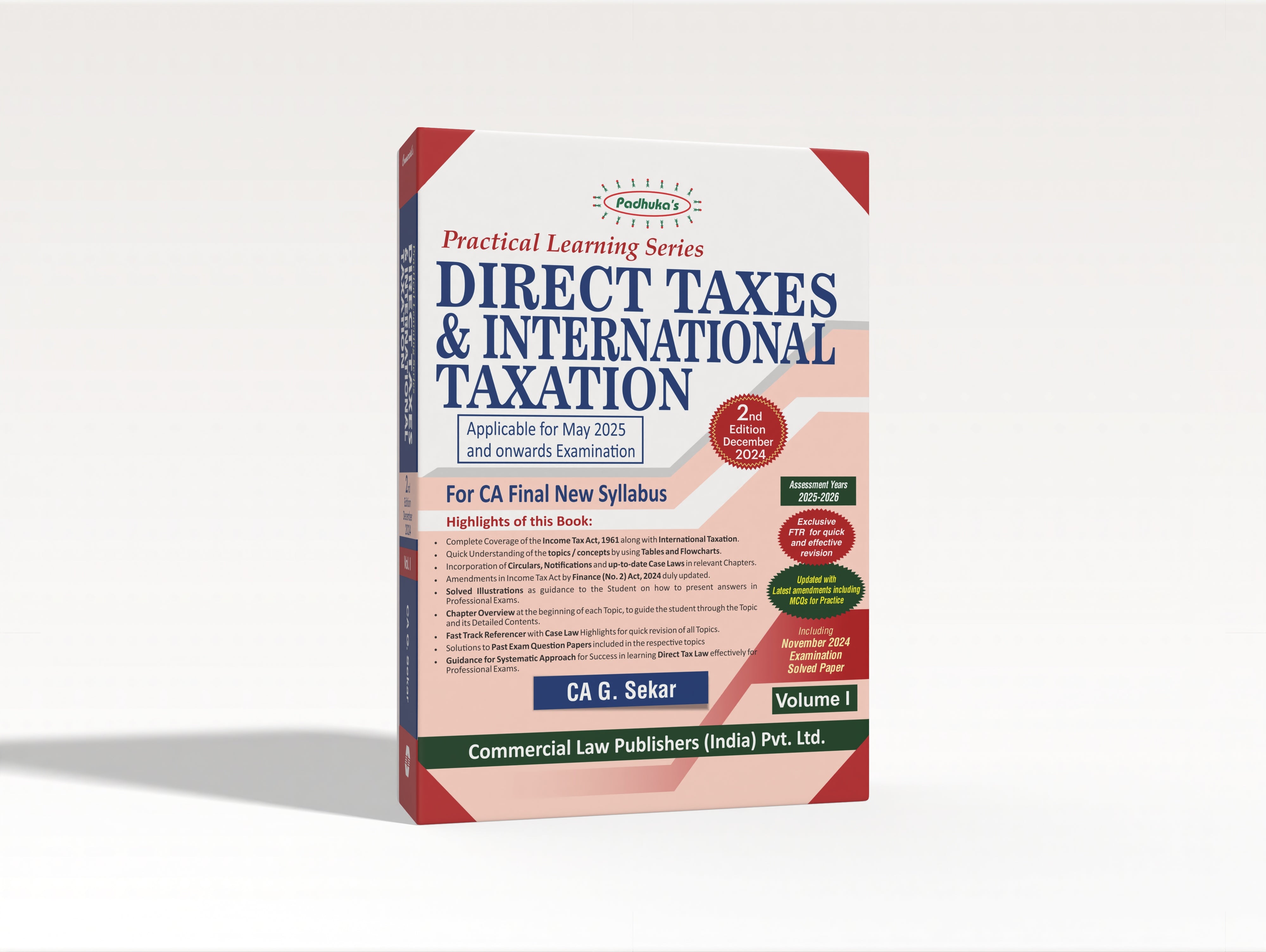

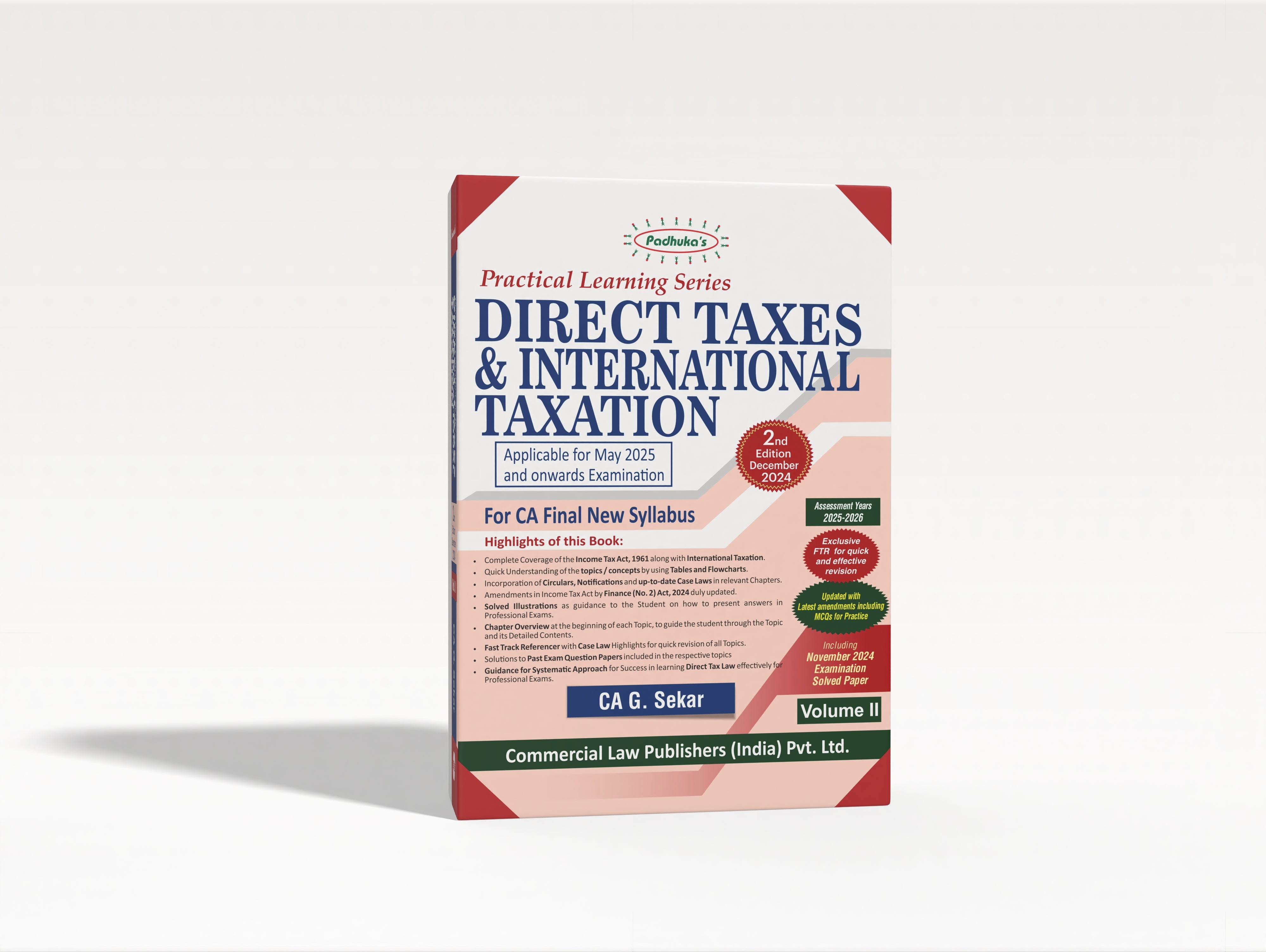

Practical Learning Series — Direct Taxes and International Taxation (CA FINAL)

This 2nd Edition (December 2024) of Practical Learning Series – Direct Taxes & International Taxation (Volumes I & II) by CA G. Sekar is meticulously designed for the CA Final New Syllabus, applicable for May 2025 and onwards examinations. Covering Assessment Years 2025–2026, this comprehensive set provides an in-depth understanding of the provisions, rules, and practical applications of Indian Direct Tax Laws and International Taxation, fully updated as per the latest Finance Act amendments.

Key Highlights:

• Complete coverage of the CA Final New Syllabus in a structured, exam-oriented manner

• Exhaustive treatment of all Direct Tax provisions including Income-tax Act, 1961, allied rules, and notifications

• Extensive coverage of International Taxation including transfer pricing, DTAA provisions, and BEPS-related updates

• Detailed explanation of concepts with practical illustrations and solved examples for better clarity

• Incorporation of past CA Final exam questions with updated solutions in line with the latest law

• Special emphasis on case study-based questions and advanced application scenarios

• Inclusion of RTPs, MTPs, and ICAI-issued updates relevant for the examination period

• Charts, tables, and flow diagrams for quick conceptual understanding and last-minute revision

• Amendments from the latest Finance Act seamlessly integrated into the main content

• Includes November 2024 Examination Solved Paper for targeted practice and self-assessment

Ideal for:

• CA Final students seeking a complete and updated guide for Direct Taxes and International Taxation

• Professionals in taxation practice or corporate advisory roles requiring a ready reference

• Trainers and faculty members looking for a well-structured teaching resource

With its blend of conceptual clarity, practical problem-solving, and exam-focused coverage, this two-volume set is an indispensable resource for excelling in CA Final Direct Taxes & International Taxation.

| Book Format | : | paperback |

| Language | : | English |

| ISBN-13 | : | 9789356036529 |

| Book Edition | : | 2nd edition, December 2024 |

Shipping & Returns

Shipping

Orders are shipped within 3–5 working days (exceptions may occur). Deliveries within Delhi usually take 3–5 working days post-shipment, while deliveries outside Delhi may take 4–5 working days. International shipping is not available at present. Once your package has been dispatched, you will receive a confirmation email with a tracking number to monitor your order.

Returns

We do not accept returns or exchanges for books once sold. A return or replacement is only possible if the book delivered is damaged or if the wrong book has been sent. In such cases, customers are requested to contact us within 7 days of delivery with order details and proof (such as a photo of the book). Refunds will be processed once the returned books are received and inspected, and the amount will be credited in the original form of payment within 7 working days. Shipping charges will not be refunded unless the return is due to our error.

Shipping & Returns

Shipping

Orders are shipped within 3–5 working days (exceptions may occur). Deliveries within Delhi usually take 3–5 working days post-shipment, while deliveries outside Delhi may take 4–5 working days. International shipping is not available at present. Once your package has been dispatched, you will receive a confirmation email with a tracking number to monitor your order.

Returns

We do not accept returns or exchanges for books once sold. A return or replacement is only possible if the book delivered is damaged or if the wrong book has been sent. In such cases, customers are requested to contact us within 7 days of delivery with order details and proof (such as a photo of the book). Refunds will be processed once the returned books are received and inspected, and the amount will be credited in the original form of payment within 7 working days. Shipping charges will not be refunded unless the return is due to our error.

Warranty

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Warranty

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Secure Payment

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Secure Payment

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

About the author

Related Products

Your cart

Your cart is empty

- Choosing a selection results in a full page refresh.

- Opens in a new window.