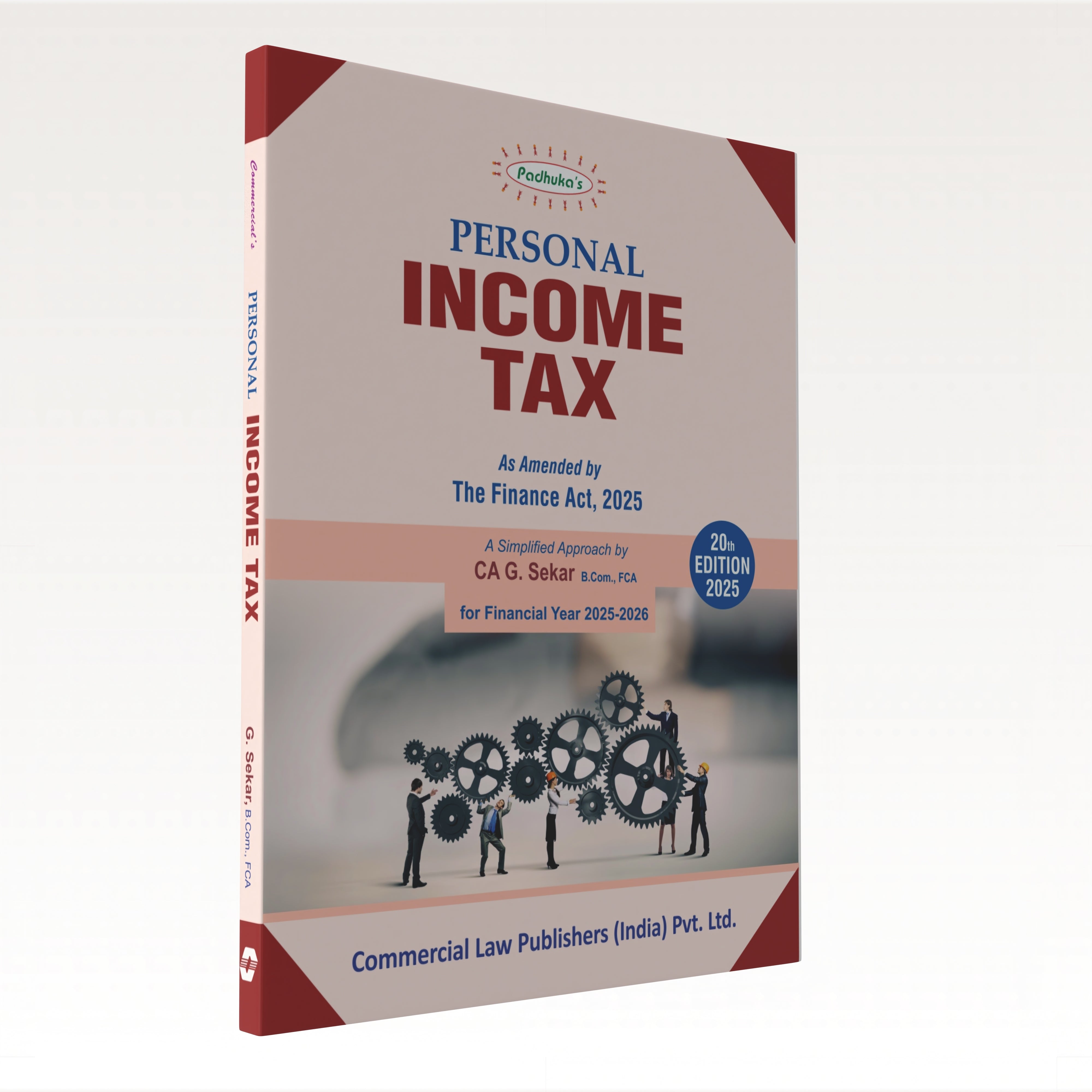

Personal Income Tax

This 20th Edition (2025) of Personal Income Tax by CA G. Sekar, B.Com., FCA, is fully updated as amended by the Finance Act, 2025 for the Financial Year 2025–2026. Written in a simplified manner, it serves as a practical and reliable guide for individuals, tax professionals, and students seeking a clear understanding of personal taxation under Indian law.

The book presents the provisions of the Income Tax Act, 1961, relevant to individuals, in a structured, easy-to-follow format. It combines statutory provisions with practical explanations, illustrations, and tax computation examples to make the subject accessible to all readers.

The content spans the full scope of personal income tax, including:

• Basic concepts of income tax law and scope of total income

• Residential status and its effect on tax liability

• Detailed computation under various heads of income – salaries, house property, business or profession, capital gains, and other sources

• Deductions under Chapter VI-A applicable to individuals

• Tax rates, rebates, exemptions, and incentives for the Financial Year 2025–26

• Set-off and carry forward of losses for individuals

• Clubbing of income provisions

• Advance tax, TDS, and tax payment procedures for individuals

• Filing of returns – procedures, due dates, and e-filing guidance

• Common errors in return filing and their remedies

• Practical illustrations for tax computation in various scenarios

• Ready-reference tax tables and compliance checklists for individuals

This edition is particularly suitable for:

• Salaried employees, professionals, and business owners managing their personal tax compliance

• Chartered accountants, tax consultants, and financial planners advising individuals

• Law and commerce students preparing for taxation subjects

• Academicians and trainers teaching personal income tax law

Whether used for self-assessment, client advisory, or academic study, this updated edition delivers a complete, practical, and easy-to-understand guide to personal taxation for the Financial Year 2025–2026.

| Book Format | : | Paperback |

| Language | : | English |

| ISBN-13 | : | 9789356036017 |

| Book Edition | : | 20th Edition |

Shipping & Returns

Shipping

Orders are shipped within 3–5 working days (exceptions may occur). Deliveries within Delhi usually take 3–5 working days post-shipment, while deliveries outside Delhi may take 4–5 working days. International shipping is not available at present. Once your package has been dispatched, you will receive a confirmation email with a tracking number to monitor your order.

Returns

We do not accept returns or exchanges for books once sold. A return or replacement is only possible if the book delivered is damaged or if the wrong book has been sent. In such cases, customers are requested to contact us within 7 days of delivery with order details and proof (such as a photo of the book). Refunds will be processed once the returned books are received and inspected, and the amount will be credited in the original form of payment within 7 working days. Shipping charges will not be refunded unless the return is due to our error.

Shipping & Returns

Shipping

Orders are shipped within 3–5 working days (exceptions may occur). Deliveries within Delhi usually take 3–5 working days post-shipment, while deliveries outside Delhi may take 4–5 working days. International shipping is not available at present. Once your package has been dispatched, you will receive a confirmation email with a tracking number to monitor your order.

Returns

We do not accept returns or exchanges for books once sold. A return or replacement is only possible if the book delivered is damaged or if the wrong book has been sent. In such cases, customers are requested to contact us within 7 days of delivery with order details and proof (such as a photo of the book). Refunds will be processed once the returned books are received and inspected, and the amount will be credited in the original form of payment within 7 working days. Shipping charges will not be refunded unless the return is due to our error.

Warranty

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Warranty

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Secure Payment

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

Secure Payment

Your payment information is processed securely. We do not store your card details nor have access to your payment information.

We accept payments via Debit Cards, Credit Cards, UPI, Net Banking, and Cash on Delivery (COD) for your convenience.

About the author

Related Products

Your cart

Your cart is empty

- Choosing a selection results in a full page refresh.

- Opens in a new window.